33+ 20 year fixed mortgage calculator

Across the United States 88 of home buyers finance their purchases with a mortgage. This calculator is for information purposes only and does not provide financial advice.

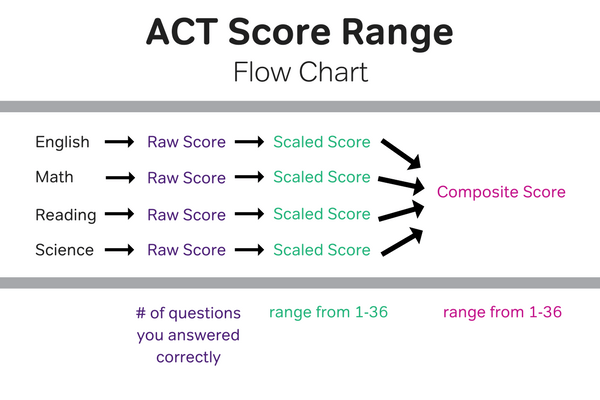

Act Scores Everything You Need To Know Magoosh Blog High School

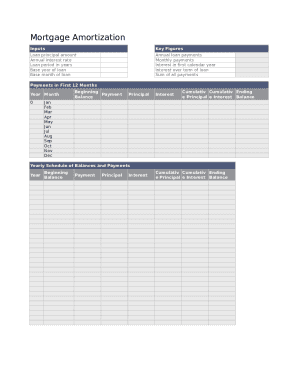

For example a 30-year fixed mortgage would have 360 payments 30x12360.

. Filters enable you to change the loan amount duration or loan type. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year. Using the above calculator you can determine your DTI ratios before you apply for a mortgage with your spouse.

Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. Its interest rate stays locked for the entire term resulting in predictable monthly principal and interest payments. This provides an opportunity to build equity at a faster pace while saving you thousands in interest once the loan is closed.

Commonly people select 3 or 10-year fixed-rate mortgages. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. In the beginning you will be paying more on interest and less on principal.

By default 250000 30-yr fixed-rate loans are displayed in the table below. This means that all your monthly payments will be the same through the loan terms. Second mortgage types Lump sum.

View listing photos review sales history and use our detailed real estate filters to find the perfect place. By default 30-year purchase loans are displayed. 10 Year Fixed Rate Mortgage Calculator.

On Monday September 12 2022 the current average 30-year fixed-mortgage rate is 608 increasing 3 basis points from a week ago. Changes in Average Loan Rates for 15-Year Fixed Mortgages. Fixed-rate mortgage interest rate and annual.

To avoid the SVR you can remortgage to a better deal which can be a five-year fixed rate mortgage or tracker. Name of lender or broker contact information. Over the past 20 years housing rates have slowly decreased.

Loan term eg 15 years 30 years Loan description eg fixed rate 31 ARM payment-option ARM interest-only ARM Basic Figures for Comparison. You must save adequate funds to cover monthly mortgage payments. Unless you come up with a 20 percent down payment or get a second mortgage loan you will likely have to pay for private mortgage.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. 15-year fixed mortgages also come with lower rates than longer payment durations.

Choose the term usually 30 years but maybe 20 15 or 10 and our calculator adjusts the repayment schedule. Use this free Texas Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. However you can get a term length ranging from 1 to 10 years.

Since extended terms take longer to pay down the lender takes on more duration risk when they secure your mortgage. On the other hand lenders assign the highest rates to 30-year FRMs. The following table highlights current Redmond mortgage rates.

However monthly minimums on shorter-term loans are much higher making 30-year mortgages much more affordable on a month to month basis. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan. Fixed-Rate Mortgage ARM 1 ARM 2 ARM 3.

The first number format refers to the initial period of time that a hybrid mortgage is fixed whereas the second number refers to how frequently the rate can subsequently adjust after the fixed period. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. We recommend seeking financial advice about your situation and goals before getting a financial product.

Just like a traditional mortgage calculator this farm land loan calculator uses fixed interest loans. If your downpayment is less than 20 percent of the homes value you must factor in private mortgage insurance PMI in your expenses. Zillow has 2352 homes for sale.

If youre in the market. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term. Current Redmond 30-YR Fixed Mortgage Rates.

Interest on a 20-year mortgage for example is likely lower. Todays national mortgage rate trends. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially.

Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. Calculate your monthly UK remortgage payments quickly using this free online calculator. To talk to one of our team at ANZ please call 0800 269 4663 or for more information about ANZs financial advice service or to view our financial advice.

But borrowers can also take 10-year 20-year and 25-year terms. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

Clicking on the refinance button switches loans to refinance. Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination.

The 3-year fixed-rate mortgage is a shorter commitment while the 10-year fixed-rate mortgage offers more stability but. This is followed by the 15-year fixed mortgage. The loan is secured on the borrowers property through a process.

Compared to a 30-year fixed mortgage 15-year fixed rate rates are. As the loan progresses more money from the monthly payment will be towards principal. It allows borrowers to qualify even if they have low credit scores.

Second mortgages come in two main forms home equity loans and home equity lines of credit. This makes it a popular financing option for buyers with tight finances. Conventional loans are commonly offered in 15 and 30-year fixed rate loans.

To get an amortization schedule for your 15-year fixed-rate mortgage use the calculator on top of this page. The most common ARM loans are 51. FHA loans come in.

With FHA loans you can make a smaller downpayment to obtain a 30-year fixed-rate mortgage.

33 Contract Templates Word Docs Pages Free Premium Templates

Autel Maxisys Ms906 Pro Car Diagnostic Scanner Upgrade Of Ms906bt Mk906bt Ecu Coding Bi Directional Control 33 Services Walmart Com

The Benefits Of Adding A Deck To Your Home Deck Designs Backyard Patio Deck Designs Patio Design

33 Free Finance Printables

33 Free Editable Amortization Schedule Templates In Ms Word Doc Pdffiller

33 Helpful Moving Tips Everyone Should Know Moving Tips Moving House Moving Truck

33 Free Finance Printables

Autel Maxisys Ms906 Pro Car Diagnostic Scanner Upgrade Of Ms906bt Mk906bt Ecu Coding Bi Directional Control 33 Services Walmart Com

I Have A Gpa Of 3 88 Unweighted And An Act Score Of 33 Are These Scores Competitive Enough For Georgia Tech And The University Of Michigan Quora

33 Mind Blowing Pinterest Stats For 2022

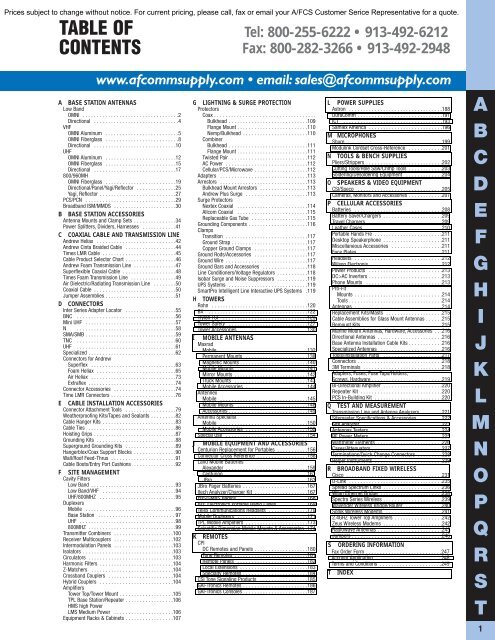

A Base Station 1 33

Deck Skirting Ideas Discover And Also Save Today S Ideal Ideas Concerning Deck Skirting Ideas On Success Gallery St Wooden Deck Designs Rustic Deck Cool Deck

Kenny Idstein Loandepot

500 Square Foot Fiberon Composite Ipe Deck With Fiberon Rosewood Inlays Picture Frame Border Stairs Patio Deck Designs Decks Backyard Deck Designs Backyard

Noontime Sun And D Vitamindwiki

2

3m Scotch Super 33 0 75 In X 12 5 Yd Vinyl Electrical Tape Case Of 24 10414na The Home Depot